By making a strategic investment in the right customer feedback system and tapping into data provided directly by your customers, you can deliver greater experiences. This will successfully set yourself apart from the competition. Robisearch Limited provides the right customer feedback platform for your company. Reach us on 071641386 or 0780655987 and get your customer feedback platform installed today!

Advantages of Using Point of Sale Systems in Hotels

A Point of sale system is a computerised system used to streamline and track transactions made within a business. A Point of sale system can be used for a variety of purposes, including sales tracking, inventory management, customer loyalty programs, and more. Below we discuss some advantages of using point of sale system in hotels.

Reducing or increasing inventory

By watching inventory reports, employees can ensure that ordering is more precise. If an organization is seasonal, it is not likely that it will need to stock the same amount of a basic product – such as flour or sugar – in the low season as it will in the high season. Watching inventory reports helps increase efficiency.

Ensuring accuracy

Every menu item in an hotel has a price associated with it. With a POS system, items are entered in single keystrokes (bar code scanning, price lookup, picture ordering, or other method) instead of open key prices. Similarly, entering prices by single descriptor increases accuracy, since employees will not be guessing, estimating, or otherwise entering incorrect prices for menu items.

Employee efficiency

Using a point of sale system will make it easier for your employees to track their sales and take customer orders. This will allow them to spend more time interacting with customers, which will result in higher customer satisfaction.

Security

A Point of sale system can help improve the security of your business by tracking employee and customer information. This information can then be used to prevent fraudulent activity and reduce theft, which is a major problem for many businesses.

Keeping track of guests

The best customers are the organisations current guests. No matter the type of operation, organizations should try to develop a database including the name and address of their most frequent guests. Mailing to guests is a direct and effective form of advertising – even if only a postcard listing a few seasonal specials. Point of sale systems include a database function whereby guest contact information can be collected and sorted.

Overall, point of sale systems can be extremely beneficial for hotels. They help to streamline communication and reduce the possibility of errors. They also provide guests with a convenient and efficient way to make payments. Point of sale systems can also help with data analytics, reporting, and improving staff productivity. If you are looking to improve your hotel’s operations, a point of sale system may be a great option for you. Contact Robisearch Limited on 0716413386 or 0780655987 for the best point of sale system for hotels and restaurants.

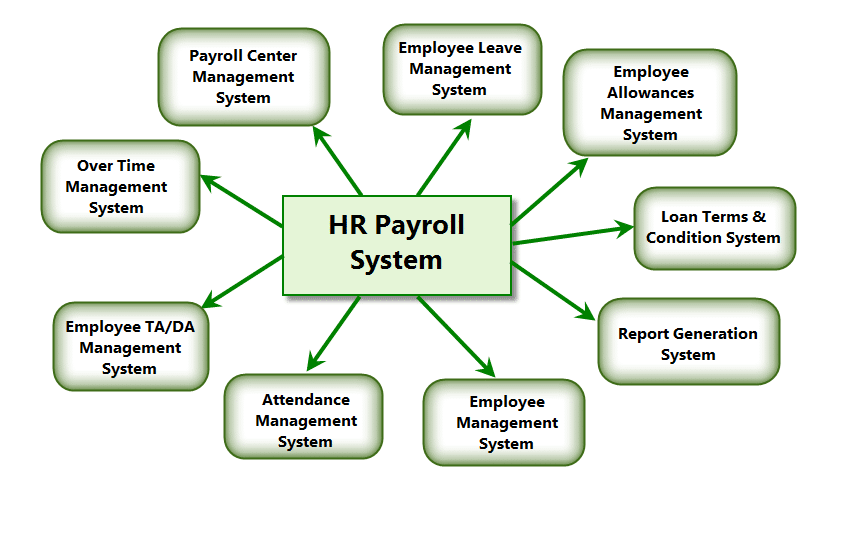

Investing in the right payroll and human resource management software will not only help the organization to run its operations in a hassle-free way but also will help the company to reach unimaginable levels of success. The software provides a number of advantages including improved efficiency, less timeline, accuracy, precision and enhanced productivity. Other benefits are discussed below:

Investing in the right payroll and human resource management software will not only help the organization to run its operations in a hassle-free way but also will help the company to reach unimaginable levels of success. The software provides a number of advantages including improved efficiency, less timeline, accuracy, precision and enhanced productivity. Other benefits are discussed below:

A customer feedback platform usually takes the form of a software product or an application. It helps businesses manage what customers are saying on multiple feedback platforms and channels. This assists in gaining data-driven insights essential to improving overall customer experience. Customer feedback platform enables everyone on your team to understand customers better. They can easily measure customer satisfaction and learn how to build customer loyalty. In return, the are able to make a digital transformation.

A customer feedback platform usually takes the form of a software product or an application. It helps businesses manage what customers are saying on multiple feedback platforms and channels. This assists in gaining data-driven insights essential to improving overall customer experience. Customer feedback platform enables everyone on your team to understand customers better. They can easily measure customer satisfaction and learn how to build customer loyalty. In return, the are able to make a digital transformation.