- Robisearch

- Corporate, Corporate Finance, Digital, Events, Industries, KENYA, Media

- November 6, 2025

visitor management system – smart check-ins with Robidigivisitor

INTRODUCATION

For decades, businesses and institutions have relied on pen and paper to record visitors. Whether at the front desk of an office, hotel, school, or event, the old logbook has been the go-to method for tracking guests. But times have changed. In a world driven by digital transformation, manual logbooks are not only outdated—they’re inefficient, insecure, and prone to error.

That’s where ROBI DigiVisitor by Robisearch Ltd comes in. This innovative visitor management system is replacing the old way of doing things with a modern, efficient, and secure digital solution.

Click here to learn more https://robisearch.com/digital-visitors-book/

The Problem with Traditional Logbooks

Logbooks may look simple, but they come with a range of hidden problems that slow down operations and create risks.

1. Time-Consuming and Inefficient

Manual entry takes time. Every visitor must write their details, which delays check-ins—especially during busy hours. Staff also waste time flipping through pages to find previous entries.

2. Prone to Errors and Illegibility

Handwriting can be unclear or incomplete, making records unreliable. Sometimes visitors provide inaccurate information, and there’s no way to verify it immediately.

3. Security and Privacy Risks

Anyone signing in can see the names and contact details of previous visitors. This compromises privacy and exposes sensitive data, a serious concern in today’s world of strict data protection laws.

4. Difficult Record Management

Paper logs pile up quickly. Storing and retrieving information from physical books is tedious and inefficient. Generating reports or analyzing visitor trends is nearly impossible without hours of manual work.

5. Unprofessional Image

In a digital era, handing visitors a pen and paper feels outdated. First impressions matter. Businesses that still rely on logbooks appear behind the times.

Introducing ROBI DigiVisitor

To solve these challenges, Robisearch Ltd developed ROBI DigiVisitor, a smart and secure visitor management system designed to make check-ins effortless and modern.

With ROBI DigiVisitor, the front desk experience is transformed. Whether it’s a security guard at a gate, a receptionist in a hotel, or an event manager welcoming guests, the system allows them to register visitors in just a few taps. Click here to learn more https://robisearch.com/digital-visitors-book/

All visitor details are digitally captured, stored securely, and easily retrievable. The system can also print visitor badges instantly, helping identify who is authorized to be on-site.

ROBI DigiVisitor eliminates the need for paper, ensures accurate data entry, and enhances overall security. It’s built for today’s fast-paced environments where efficiency, accuracy, and professionalism are essential.

Key Advantages of ROBI DigiVisitor

1. Fast and Seamless Registration

Visitors no longer have to fill out lengthy forms. With ROBI DigiVisitor, all details—such as name, contact information, purpose of visit, and time—are recorded instantly. The system simplifies entry even during peak hours.

2. Real-Time Tracking

Every check-in and check-out is tracked in real time. Admins can see who is on the premises at any moment, improving both security and accountability.

3. Instant Badge Printing

ROBI DigiVisitor can print customized visitor badges on the spot. These badges help staff easily identify authorized guests and maintain control over access.

4. Enhanced Data Accuracy

Digital entry ensures clean, consistent, and complete data. There’s no guessing what someone wrote, and records remain easy to read and process.

5. Secure Data Storage

All visitor information is stored in a secure digital database, protecting it from loss, damage, or unauthorized access. Unlike paper records, data can be safely backed up and encrypted.

6. Simplified Reporting and Analytics

ROBI DigiVisitor makes it easy to generate reports for management or compliance purposes. You can filter by date, location, or visitor type to understand patterns and improve operations.

7. Professional Image

When guests arrive and experience a fast, modern check-in process, it immediately communicates professionalism and efficiency. This small detail helps build trust and confidence in your organization.

8. Cost and Time Savings

Automating visitor management reduces paper costs, manual labor, and storage space. Over time, the system pays for itself through increased productivity and better visitor flow.

9. Eco-Friendly

By going paperless, ROBI DigiVisitor supports sustainability. Businesses can reduce paper waste and contribute to environmental conservation.

10. Multi-Sector Application

The system is flexible and ideal for:

Offices – streamline employee and guest visits

Hotels – enhance guest experience at reception

Schools – track parents, students, and visitors

Events – register attendees smoothly

Military or gated areas – ensure accurate visitor verification

Why Businesses Are Switching to ROBI DigiVisitor

The move toward digital transformation isn’t just a trend—it’s a necessity. Businesses are realizing that manual methods no longer keep up with modern demands. Visitor management is a critical part of daily operations, and automating it makes a measurable difference.

With ROBI DigiVisitor, you don’t just improve efficiency—you also elevate the entire visitor experience. The system ensures accurate, fast, and secure registration, freeing up staff to focus on more valuable tasks instead of paperwork.

Security officers at gates, receptionists, and event managers have one unified tool that keeps everything organized. The result is smoother operations, fewer errors, and a professional environment that leaves a lasting impression. Click here to view it https://robisearch.com/digital-visitors-book/

The Future of Visitor Management Is Digital

Logbooks had their place in the past, but the future belongs to digital systems like ROBI DigiVisitor. Businesses that adopt such tools position themselves as forward-thinking, customer-centered, and tech-ready.

As more organizations embrace automation, those still clinging to manual systems risk falling behind. The shift to digital visitor management is not just about convenience—it’s about security, compliance, and brand reputation.

ROBI DigiVisitor is built to handle all that with simplicity and efficiency. It is the ultimate solution for any organization that values safety, professionalism, and modern service delivery.

Upgrade Your Front Desk Today

Say goodbye to paper logbooks and embrace the future of visitor management with ROBI DigiVisitor.

Let Robisearch Ltd help you digitize your front desk, improve efficiency, and secure your visitor records.

Experience smart check-ins today—because first impressions start at the door. Click here https://robisearch.com/digital-visitors-book/

Call 0716413386 | 0780655987

- Robisearch

- Best POS in Kenya (East Africa), BEST POS IN NAIROBI, Business Growth, Corporate, Corporate Finance, Information Technology

- September 21, 2025

7 Ways ROBIPOS System Can Increase Your Business Profit.

7 Ways ROBIPOS System Can Increase Your Business Profit.

Every entrepreneur and corporate leader knows that profit is not just about selling more—it’s about running smarter. The way you process sales, manage inventory, handle customers, and track performance determines whether your business grows or struggles.

That’s why many businesses in Kenya are turning to RobiPOS by Robisearch Ltd. It’s more than just a point-of-sale system—it’s a complete business management tool designed to help you increase efficiency, cut losses, and maximize profits.

Here are seven powerful RobiPOS features that directly contribute to your business growth:

1. Faster Sales Processing and Transactions

Long queues frustrate customers and slow sales. RobiPOS ensures quick and accurate checkouts, supporting payments through cash, cards, or M-Pesa. The smoother the transaction, the more sales you complete—and the more revenue you keep flowing.

2. Smarter Inventory Management

Stock control can make or break profits. RobiPOS helps you avoid both overstocking and running out by offering:

● Real-time stock tracking

● Low-stock alerts before items run out

● Multi-location stock monitoring

● Product variation management (sizes, brands, colors)

With better control, you reduce waste, prevent theft, and keep your shelves stocked with what sells best.

3. Professional Invoicing and Billing

Paper-based invoicing is slow and error-prone. RobiPOS lets you generate professional invoices instantly, offer customer credit safely, and even customize invoice formats to suit your brand. This not only improves customer trust but also ensures you get paid faster, keeping cash flow strong.

4. Reports and Analytics That Drive Growth

Decisions backed by data are always smarter. RobiPOS generates detailed reports, including:

● Daily, weekly, and monthly sales summaries

● Product category performance

● Employee productivity

● Best-selling products

These insights show you exactly where your money comes from and where you’re losing it—helping you make informed moves that grow profit.

5. Customer Management That Builds Loyalty

Profit isn’t just about first-time sales—it’s about repeat customers. With RobiPOS, you can securely store customer details, track purchase history, and even create reward programs. This keeps customers coming back and spending more, building long-term revenue.

6. User Access and Security

Every shilling counts, and you can’t afford fraud or mistakes. RobiPOS allows secure logins, assigns staff permissions, and restricts unauthorized access. This accountability reduces losses and ensures you stay in control of your business operations.

7. Seamless Integrations for Efficiency

RobiPOS connects effortlessly with payment processors, barcode scanners, printers, and cash drawers. These integrations save time, reduce errors, and streamline operations—turning your shop into a high-performing, profit-driven business.

Bonus: Human Resource Management

Beyond sales, RobiPOS also tracks staff attendance, monitors performance, and manages commissions. With better oversight, your employees become more accountable, and your business runs more profitably.

tools

Why RobiPOS is the Smarter Choice

At Robisearch Ltd, we’ve built RobiPOS to meet the real needs of businesses—from retail shops and supermarkets to pharmacies and corporates. It’s easy to use, mobile-friendly, and fully integrated with M-Pesa, banks, and bulk SMS.

If you’re serious about growth, it’s time to move beyond ordinary POS systems. With RobiPOS, every feature works toward one goal—increasing your profit.

Ready to see it in action?

Book a free demo today at www.robisearch.com

or

call 0780 655 987 / 0716 413 386

- Robisearch

- Business Growth, Corporate Finance, Information Technology, Uncategorized

- March 7, 2023

How Banks and Financial Institutions Can Benefit From Bulk SMS

Today, an increasing number of organizations are adopting bulk SMS services to communicate with customers more efficiently than ever and deliver better and more effective customer service. With bulk SMS service, businesses can run customizable SMS campaigns to ensure higher open rate and an impression conversion ratio.

In this blog, we will discuss the role and benefits of bulk SMS services for the banking and financial sectors. They include:

High response rates

SMS messages have high open and response rates, because customers are more likely to read and respond to them compared to other forms of communication. This can be particularly useful for financial institutions that need to communicate important information or gather feedback from customers.

Fraud prevention

Having specialized bulk SMS software at your disposal boosts your chances of fraud prevention. Such software allows you to stay in contact with your customers constantly, allowing you to notify them whenever any suspicious transaction occurs.

Cost effective

Bulk SMS services are more cost-effective than other forms of communication, such as direct mail or telemarketing. This can be an important feature for financial institutions that need to communicate with large numbers of customers on a regular basis.

Fast and efficient

Bulk SMS services allow financial institutions to send large numbers of messages to customers quickly and efficiently. This can be especially useful for sending time-sensitive updates and notifications.

Customization and targeting

Bulk SMS software such as Robisearch Limited SMS allows financial institutions to tailor their messages to specific groups of customers based on their preferences and needs. This can help improve the effectiveness of marketing and promotional campaigns by making them more relevant and engaging.

Easy to use and track

The software comes with a state-of-the-art dashboard, giving you access to specialized tools to track the effectiveness of your organizational messages and campaigns. This particular feature can help financial institutions optimize their communication strategies and better understand their customers’ needs and preferences, as well as evaluate the engagement data.

Sending account alerts and transaction notifications

Financial institutions can use bulk SMS to send account alerts, such as low balance notifications, transaction alerts, and account activity updates to customers. This can help customers stay on top of their finances and reduce the risk of fraud or unauthorized transactions.

Providing customer support

This bulk SMS software can be used to not only provide customer support but also to improve it, by answering frequently asked questions (FAQs) and assisting customers with their account issues. This, again, not only improves customer satisfaction but also reduces the workload on the customer service staff.

Marketing and promotional campaigns

Financial institutions can use bulk SMS to promote new products and services, as well as special offers and discounts. This can help increase customer engagement, drive sales, and increase revenue.

Communicating with clients in case of emergencies

In the event of a natural disaster or other emergencies, financial institutions can use Shree Tripada SMS software’s bulk SMS service to quickly communicate with customers and provide important updates and instructions.

Internal communication

You can also use the software for internal communication within your financial institution, such as sending updates to employees or reminding them of upcoming meetings. This can help improve productivity and keep every stakeholder informed of the organization’s operational whereabouts.

In conclusion, Bulk SMS services can assist banks and financial institutions in streamlining their customer communication. Choosing the right software can ensure a safe and secure banking environment. Thanks to bulk SMS software programs, promoting your services and engaging with your customers have gotten easier than ever. Contact Robisearch Limited today on 0716413386 or 0780655987 for the best bulk SMS solution in the market.

- Robisearch

- Business Growth, Corporate Finance, Uncategorized

- February 15, 2023

Benefits of Accounting Software To Small Businesses

Accounting software is used to collect, record, categorize, manage, access and share accounting data and other financial information from a single platform. It saves companies time and money by automating manual functions, such as creating journal entries, generating financial statements, updating key reports, managing payroll and expenses, and syncing data across different departments.

Saves time and automation

Any good accounting software can automate invoicing by delivering invoice and payment reminders that include links for the appropriate online payment methods. Automation can also help accounts payable, by scheduling bank payments and direct deposits; tax payments, by entering data into the most common tax forms and electronically filing them and payroll, by calculating hours and taxes, processing wages and paying payroll taxes. This elimination of manual processes saves time and improves accounting accuracy.

It gives detailed insights

If your chart of accounts is set up properly, you can use accounting software to track your transactions by departments, projects, locations, or classes. This gives you a clear picture of what your income is attributable to and your areas of expense, helping you generate more specific reports and make strategic decisions.

It reduces inventory errors

The Robisearch accounting software includes basic inventory management tools that automatically update to show the number of each product you have on hand, what’s been sold, and when you need to restock. Accounting software is an easy way to get accurate, real-time information on your stock levels instead of relying on error-prone manual data entry.

More productive employees

By automating routine accounting processes, software can transform key employees from passive caretakers of financial data to proactive creators of business value. Accounting software’s core capabilities — increased accuracy, real-time data delivery, visibility and collaboration — help teams develop better business strategies and communicate across departmental silos, both of which facilitate better-informed decisions.

Remote access

Remote work caused by the pandemic has prompted many accounting departments to add cloud-based accounting systems that make real-time data and information accessible to authorised employees from any place, at any time and on any device. Those features improve efficiency, accuracy, collaboration and decision-making.

Lower cost

The system saves cost, time and resources. Since the software no longer resides on a business’s computers or network, the cloud-based system frees up valuable computing space and allows IT staff to focus on other tasks. Automatic software updates eliminate fees for new licenses, hardware, system maintenance and integration. Those benefits are especially important for businesses in volatile or dynamic markets.

Security and continuity

Accounting software uses encryption and other layers of security to protect data and authenticate users. This is especially important for cloud-based software, where the data resides on a remote server; crucial information is also protected in case of a lost or stolen mobile device or in the event of a fire or other disaster. And small businesses can obtain the same level of security as bigger companies.

No matter the size of a company, the accounting software can help it become more efficient and competitive by streamlining, automating and optimizing accounting and financial operations that were once done manually. Robisearch accounting software makes it easier to enter, manage, track, update and customize core processes, such as accounts, journal entries, transactions, and billing and invoicing, through its dynamic general ledger. Contact us 0n 0716413386 or 0780655987 for a customized accounting system for your business.

- Robisearch

- Business, Corporate Finance, Performance Improvement

- June 20, 2022

WHY ACCOUNTING SOFTWARE IS IMPORTANT FOR SMALL BUSINESSES

Running a small business often means wearing many hats — sending emails, paying suppliers, invoicing, crafting workflows, and building financial reports. All these are must-dos, in addition to actually delivering the job that customers or clients pay for.

Of all the extra tasks small business owners have on their plate, none are quite as important as accounting. Solid accounting practices keep your business in top financial shape and help you make better decisions, while dropping the ball on accounting can cause business collapse or trouble.

Thankfully, small business software solutions are making it easier to outsource tasks to technology. These accounting tools help business owners to track accounts receivable and payable, pay sales tax and

Bookkeeping software vs. accounting software

The easiest way to understand the difference is to think of bookkeeping as the basic and accounting as the advanced. Bookkeeping software is used for data entry and storage — e.g., logging revenue and expenses. The best bookkeeping software will make that process smoother than, say, a spreadsheet. You can run double-entry accounting: managing incoming and outgoing expenses and payments for better oversight.

Accounting software is like the upgraded version of bookkeeping software. Accounting software should have the same functionality — data entry and storage. In addition it gives you more analytics and actionable accounting features, like forecasting and cash flow analysis.

Bookkeeping and accounting software both reduce the amount of time spent on data entry. Users can simply sync business bank accounts and credit cards. Automation takes uploading out of your hands. For the purpose of this article, we will focus on accounting software.

Why accounting software is important for small businesses

Oversight helps you to plan, spot potential issues, identify strengths and prove business viability. With this information, you can confidently make investments, ask for loans and predict what your tax requirements will be.

Here are seven features that make accounting software so impactful for small business owners:

Bank and credit card syncing

Syncing your bank account and credit cards with your accounting software is the greatest timesaver that accounting software can give you. Removing manual input of financial data gives you back hours of your working life to focus on other important business tasks.

Invoicing

Invoicing software is an important feature of your accounting platform. It means that once the payment is made, it’s automatically registered as paid. With your bank and credit card synced, and your invoice logged as it’s sent out, your accounting system will pick it up once paid. No data entry is required from you once the invoice is sent. Most solutions will include templates.

Accounts receivable

By adding your invoices to your software solution, you are able to have a view of your accounts receivable. This means the amounts owed to the business. Overview of your accounts receivable is helpful for financial reporting.

Accounts payable

Accounts payable is essentially expense tracking: all of the invoices or expenses that the business is due to pay. Your accounting software can make it easier to manage these by putting them in the system. Adding due dates and having this chart of accounts easily viewable helps you prioritize payments and not let any fall through the cracks. Registering this information also allows you to assess your profitability based on your incoming and outgoing payments.

Online payment collection

Most accounting software tools will have features that allow you to collect online payments from customers. This makes it easier for customers to pay their bills, which helps you secure payments in a timely manner.

Shared access

There are a few benefits to shared access that are both within and outside of your organization. Internally, you can share access with any team members that may send invoices to clients or are responsible for paying company bills. Outside of your business, you can share access with your bookkeeper, accountant, and tax professionals to make their life easier, saving them time and saving you money that would have been spent on their time.

Financial statement preparation

Your accounting software can help you easily prepare balance sheets, profit and loss statements, and cash flow statements. With all of your financial data in one system, the analytics capability lets you create complex reports quickly.

- Robisearch

- Business, Business Growth, Corporate Finance, Information Technology

- May 28, 2022

Business Management Software and why you need it

A business budget is a spending plan for your business based on your income and expenses. It identifies your available capital, estimates your spending, and helps you predict revenue.

A budget can help you plan your business activities and can act as a yardstick for setting up financial goals. It can help you tackle both short-term obstacles and long-term planning.

Most companies have several items they must pay consistently — daily, weekly, monthly, quarterly, yearly or otherwise — to maintain business operations. Budgets are important to ensure payment of these expenses and so the company can prevent any long-term debts. Without a budget, a business may experience any number of consequences, up to and including the dissolution of the company. Some of the items that a business may be responsible for paying include:

-

Payroll: This can include everyone at the company, even the owner if they currently take a salary.

-

Rent: Most companies lease an office, a warehouse, a brick and mortar location or other space where it conducts business and they must pay rent promptly.

-

Utilities: Along with the lease of space comes utilities for electricity, water, internet and phone.

-

Insurance: Insurance may include general liability insurance, property insurance and coverage for unemployment and workers’ compensation.

-

Professional services: A company may have expenses to keep the company operational. These can include IT services, printer repair expenses, a tax professional and even a cleaning team.

-

Advertising: It’s common for a business to want to engage in some advertising to increase sales or brand awareness. Advertising costs money and may very well be a regular expense that a company is responsible for.

-

Loans: A company may have loans they have to repay for opening the business, for gaining capital from investors and more.

The following are some of the reasons why it is important for businesses and companies to have the Business Management software in their premises;

Prepare for emergencies

You never know what can come up in the course of doing business, so just as in personal life, it’s important to plan for the unexpected in business. A budget can help you set aside money in the event of an emergency so you don’t have to grab funds from some other part of business operations instead.

Attract investors

Investors want to see that a company has their dollars accounted for. A well-formed budget shows organization and a commitment to the business that an owner without a budget may not showcase. When an investor sees budget sheets and can understand how much money the company anticipates bringing in and what its expenses are, he or she may then have more confidence in investing.

Set sales goals

Some expenses are associated with having a sales team or sales processes, and the budget can account for these. The budget can also include how much sales you expect the business to earn in a certain timeframe. With these items in place, you can set sales goals that align with the budget, adjusting as needed later on.

Meet financial goals

Every company should have financial goals that, if reached, means the company did well for the year and can continue operations as normal or even expand as needed. Without a budget in place, a business owner may not have an idea of how the company is doing and only realize after the year is over that the company isn’t making a profit. A budget can keep a business owner and all stakeholders on track to meet goals because there is a better awareness of where the money is coming in and being spent.

Pay off debt

Paying off debt is a major benefit of having a budget. A budget should include line items for each expense, with current debt being just one of them. As long as a business owner follows the budget and accounts for the monthly or quarterly debt payments, then they should be able to pay the debt off promptly.

Easily prepare taxes

Whether you do business taxes yourself or hire a professional, having a budget can make it easier to complete this process. For example, you can invest in tax preparation software or have someone on retainer who can file taxes for you. Your budget will make their process go faster too, potentially saving you money.

Make large financial decisions

Most business owners are responsible for larger business decisions that will impact the money moving into and out of the company. With a budget, you will likely find it easier to make necessary decisions like how much you can afford to increase salaries, if bonuses can be available for team members, what benefits you can offer employees or if there is the opportunity to increase operations.

At Robisearch, we ensure that the Budget Management Software in our system can serve your business effectively and efficiently.

- support@robisearch.com

- Business, Business Growth, Corporate Finance, Time Management

- May 27, 2022

Kenya’s Best ERP System: Simplifying Employee Management with Time and Leave Tracking

Introduction

What is an ERP system?

How can an ERP system help businesses in Kenya?

Happy & confident employer and employees in their workplace

How is the ROBISEARCH ERP system different from others on the market?

What are the benefits of using the ROBISEARCH ERP system?

- Increased efficiency and productivity in the workplace

- improved decision making due to access to real-time data

- improved customer service

- reduced operating costs

- Increased job satisfaction and motivation

- Easier to plan and manage their work schedule

- Improved work/life balance

WOC having the time of their life.

How does the ROBISEARCH ERP system work?

Case study: How the ROBISEARCH ERP system helped one business in Kenya

Conclusion:

- support@robisearch.com

- Business, Business Growth, Corporate, Corporate Finance, Organization, Performance Improvement, Results Delivery, Strategy

- April 27, 2022

BUDGET MANAGEMENT SYSTEM IN KENYA

Most individuals and businesses have funds and resources that they would like use, spend or save, for a variety of reasons. Everybody has the freedom to do so. However, most of us end up wasting funds unknowingly and later on end up with little to no money. This mostly happens because we spent more money than they could make and probably did not keep track of the spending. Therefore, some people decided to come up with a plan that would help them know how they are going to spend their money. This spending plan is what is

known as a budget.

Budgeting is the process of creating a plan to spend your money. Most people do it manually using a bit of math here and there. It works only if one did it correctly and followed strictly. However, trying to account for large sums of money needed and resources available manually became tedious and time consuming. A lot of people would encounter budgeting errors due to miscalculation. This is where a Budget Management System comes in.

The Budget Management system helps you to plan for your expenses, allocate funds, and budget for other expenditures, then compare them later to see which exceeded and which matched well for the planning of the next budget. This system is very common and we use in various sectors in Kenya, from SMEs, large corporations and even all the way to the National government. Budgeting involves four major processes, as shown below.

Major Processes involved in Budgeting

- Budget Preparation

- Budget Authorization

- Budget Execution

- Budget Accountability

The processes involved in budgeting tend to overlap each other during implementation process.

TYPES OF BUDGETING

Basic Budget – its main purpose is to help map out simple expenses and income. A basic budget can be created in a spreadsheet or using a template and it is great and useful for home and business planning. They are usually easy to use and flexible, as most people use it with ease. It is very useful when you need to map out simple accounting information like personal or business expenses.

Master budget – The purpose of the master budget is to include smaller operation budgets and provide a larger picture of individual income and expenses. It gives a generalized picture of expenses as a whole. A business can utilize a master budget to plan for general expenses and identify expenses at a glance.

Short-term budget – this type of a budget aids enterprises or individuals plan for short term expenses and manage funds in a shorter time span (anywhere from a week to a few months). It provides a more focused look into short-term expenses, income sources and budgeting goals. They are great for clearing short-term debt too.

Fixed Budget – This type of budget controls when income and expenses aren’t expected to change in the short-run. It is very useful in providing a simple picture of fixed income and expenses. It can be used for everyday income and expense tracking especially when you are not expecting any change in either.

Flexible Budget -for planning different levels of activity in incomes or expenses in the short-term or long-term. It offers more flexibility to the budgeting process, planning for varying activity levels in the company’s picture.

It is generally used when one is expecting different volumes for incomes and expenses.

Labour budget – tracking the cost of labour in relation to revenue. It is part of the master budget that focuses only on labour for a more specific view of an individual expense. It is therefore used to track general labour costs or plan for upcoming reductions or increases in labour needs.

Cash Budget – this type of budget is used to plan for cash flow (inflow and outflow) for a specific period of time, usually in the short term. It focuses mainly on cash inflows and outflows for a more specific financial picture. Recommended for use when you are expecting a larger volume in cash flow.

Operational Budget – also known as a functional budget. It applies to one specific operation of a business is part of the master budget. The advantage is that it only applies to a specific department, operation or function of a business, instead of the business as a whole.

It is considered only a good option for when you are overhauling a specific department or operation of a business.

Performance budget – it is designed to analyze the performance or aspect of a business and determine whether the cost is worth the output and result. It focuses on a specific aspect of a business and helps determine if the input is worth the Return of Investments (ROI).

Can be used to identify costly methods of production and determine if certain functions and operations are creating a ROI.

Static budget – Used to account for astatic expenses that won’t change. Allow for a focused look at fixed expenses that remain constant despite fluctuations in sales volume and revenue.

Function of a Budget Management System for Businesses.

The Budget management System helps you set up and manage budgets for your business. It becomes very easy to understand how it works once you understand the kind of budget that will help you achieve the goals that you have set.

Furthermore, it also helps you view budgets and even generate a proper budgeting report. With such reports, you can also track budget performance against your actuals using the Profit & Loss Report feature.

Finally, a proper budgeting and accounting system can help you control and reconcile money between your business bank accounts.

At Robisearch Ltd, this feature is integrated in most of our systems as a module. It generally even makes work easier for those in charge of accounting and finance.

Robisearch Ltd offers the best digital solutions for businesses; SMEs to large corporate businesses.

- robisearch robisearch

- Business, Business Growth, Corporate Finance

- March 22, 2022

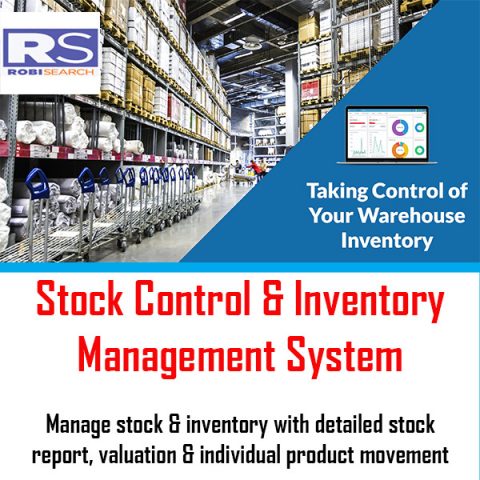

Top 5 Features for a good Inventory Management System

Top 5 Features for a good Inventory Management System – Inventory, often called merchandise or product, refers to finished goods and materials that a business holds for sale to customers in the future. These goods and materials serve no other purpose in the business except to be sold to customers for a profit. The value of a company’s inventory is usually one of the largest assets on the books.

Inventory management systems support the activities of purchasing product, analyzing sales trends and on-hand inventory availability as well as liquidation of product for wholesale, distributors, eCommerce retail and manufacturing companies. Managing inventory is a critical component to Supply Chain Management.

Robisearch LTD offers software for manufacturers, wholesalers, and distributors, the purchasing departments who are responsible for acquiring the new product and reordering existing products. In retailers and e-commerce companies, the purchase and reorder of inventory is done by merchants (buyers) or inventory control personnel.

Top 5 important inventory management features

Here are some of the Top 5 Features for a good Inventory Management System that Robisearch’s ROBIPOS offers.

1. Improved inventory control and forecasting/projection

As simple as this sounds, this should top your list. How should this new system assist in managing and controlling inventory? Here are a few major features and functions you can get in Robisearch’s POS software:

- A robust item master module such as product costing methods and product characteristics.

- Projecting and Forecasting demand – As in, the system will calculate the quantity of a product required forward over a time horizon.

- Provision of the channel view for multichannel businesses such as Wholesale and Retail.

- Streamlined Analysis and purchases functions.

2. Barcoding & Scanning

A barcode is a visual, machine-readable representation of data. Essentially, it is electronic data entry using a scanner. The data contained in the barcode is typically tied to something, lot number, customer shipment, or a purchase order. Once scanned, this data is accessed and displayed for the user to learn more information or take an action.

Bar code functions may be provided by the vendor.Robisearch’s inventory software support the use of barcode.

3. Improved, actionable inventory analysis

As we said earlier, there are literally hundreds to thousands of data elements in inventory management systems. What “out of the box” inventory management analyses are offered and do they fit your method of managing inventory?

Robisearch’s System points the purchasing agent or inventory manager to which products to take action on. For example, the system flags potential stock outs; calculates recommended purchase orders; and candidates for overstock liquidation.

4. Configurability

This feature allows a single system to be set up and configured for two different business entities/companies so that each has a different “look and feel” or personality. In this way, the more comprehensive systems are successfully implemented across industries and merchandise without customization.

Robisearch’s systems have configurability to some degree, let’s see what does it allow you to accomplish.

Examples of configuration include:

- A product with different colors and sizes may be configured in a way to show total product sales and stock on-hand by style or base product.

- A role (group of users) or individual configuration table of users that allows for the set-up of data security functions within your organization for updating and viewing data.

- Flexibility for controlling different types of hardware or interfaces connected to the inventory management system.

- Adoption of your detailed expense accounting structure.

6. On-premise versus Software as a Service and Cloud system

For many companies, cloud-based and Software as a Service (SaaS) subscription made inventory management systems more affordable than on-premise implementations and supported systems because they are based on the number of users and data storage usage, Additionally, implementation is accomplished in a shorter timeframe because they are a service requiring less IT time internally. Robisearch’s POS software supports both On-Premise ans as a cloud software; The key question here is what is the right IT strategy for your company?

OFFICES: SURAJ PLAZA, LIMURU ROAD, OPPOSITE JAMHURI HIGH SCHOOL

Email: info@robisearch.com, sales@robisearch.com, robisearch@gmail.com

CONTACT US: Website: www.robisearch.com

Facebook: robisearch limited Twitter: @robisearch LinkedIn: robisearchlimited1 Instagram: Robisearch